ConocoPhillips Shares: A Comprehensive Overview

Introduction:

ConocoPhillips is a prominent energy company that specializes in exploration, production, refining, and marketing of oil and natural gas. This article provides a detailed analysis of ConocoPhillips shares, including an overview of what they are, the different types available, their popularity, and quantitative measurements. Additionally, it explores the distinctions between various ConocoPhillips shares, their historical advantages, and disadvantages.

Overview of ConocoPhillips Shares:

ConocoPhillips shares represent ownership in the company and provide investors with a way to participate in the company’s financial performance. As a public company, ConocoPhillips offers shares to raise capital for its operations, while simultaneously allowing investors to invest in the company’s potential growth and profitability. These shares are traded on major stock exchanges, providing liquidity for investors who wish to buy or sell them.

Types of ConocoPhillips Shares:

ConocoPhillips offers two primary types of shares: common shares and preferred shares. Common shares are the most common type of stock and grant shareholders voting rights in corporate matters. Preferred shares, on the other hand, do not carry voting rights but provide shareholders with a higher claim to the company’s assets and earnings. Preferred shares typically offer a fixed dividend, making them popular among income-seeking investors. These shares can be further classified into various series, each with its own unique characteristics.

Popularity of ConocoPhillips Shares:

ConocoPhillips shares have gained popularity among both institutional and retail investors. The company’s strong financial performance, global footprint, and commitment to shareholder returns make its shares an attractive investment option. Additionally, ConocoPhillips’ focus on efficient operations and capital discipline adds to its appeal. As a result, many financial advisors recommend including ConocoPhillips shares in diversified portfolios to potentially benefit from the energy sector’s growth.

Quantitative Measurements:

To assess the attractiveness of ConocoPhillips shares, investors often consider various quantitative measurements. These measurements include financial ratios such as price-to-earnings ratio (P/E), price-to-book ratio (P/B), and dividend yield. The P/E ratio reflects the valuation of the shares relative to the company’s earnings, while the P/B ratio compares the share price to the company’s book value. Dividend yield indicates the annual dividend income relative to the share price. Analyzing these ratios provides insights into the share’s valuation and potential returns.

Differences between ConocoPhillips Shares:

Different classes of ConocoPhillips shares may vary in terms of voting rights, dividend payouts, and priority in the event of liquidation. Common shares offer voting rights, allowing shareholders to have a say in major corporate decisions. Preferred shares, on the other hand, prioritize dividend payments and liquidation proceeds over common shares. Understanding these distinctions is crucial for investors looking to align their investment objectives with the specific characteristics of each share class.

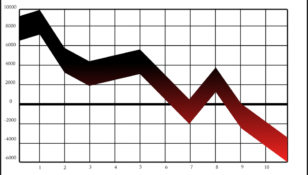

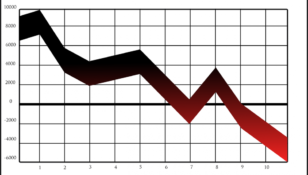

Historical Overview of Advantages and Disadvantages:

Over the years, ConocoPhillips shares have demonstrated several advantages and disadvantages. Historically, the stock has benefited from the company’s strong financial performance, robust dividend payments, and strategic initiatives. However, the company’s dependence on oil prices and market volatility has also led to drawbacks. Fluctuations in commodity prices can impact ConocoPhillips’ financial results, causing share prices to fluctuate. Additionally, regulatory changes, geopolitical events, and environmental concerns pose risks to the company’s long-term prospects.

Conclusion:

ConocoPhillips shares offer investors an opportunity to invest in an established energy company with a global presence. Understanding the different types of shares, their popularity, and quantitative measurements is vital for making informed investment decisions. While the performance of ConocoPhillips shares can be influenced by various factors, historical patterns suggest both advantages and disadvantages. As with any investment, thorough research and consideration of individual financial goals are essential. Investing in ConocoPhillips shares should be part of a well-diversified portfolio tailored to an investor’s risk tolerance and investment horizon.

(optional – appropriate financial advice-related video)