Norwegian Aksjer: A Comprehensive Guide to Investing in the Norwegian Stock Market

Introduction:

The Norwegian stock market, also known as «Norwegian Aksjer,» offers a wide range of investment opportunities for individuals and institutional investors alike. In this comprehensive guide, we will provide an in-depth overview of Norwegian Aksjer, detailing its types, popularity, quantitative measurements, differences between various stocks, and a historical analysis of the advantages and disadvantages associated with investing in different Norwegian Aksjer.

Overview of Norwegian Aksjer

Norwegian Aksjer refers to the shares of Norwegian companies that are listed and traded on the Norwegian stock market, primarily on the Oslo Stock Exchange. The Oslo Stock Exchange is the largest exchange in Norway and offers a well-regulated and transparent platform for investors to buy and sell stocks.

Investing in Norwegian Aksjer provides investors with the opportunity to gain exposure to various sectors of the Norwegian economy, including energy, finance, technology, and shipping. Norwegian Aksjer can be an attractive investment option for both domestic and international investors due to Norway’s stable and well-regulated financial market.

Types and Popularity of Norwegian Aksjer

There are several types of Norwegian Aksjer available for investors. These include common stocks, preferred stocks, and exchange-traded funds (ETFs). Each type of stock has its own unique characteristics and investment potential.

Common stocks are the most common type of Norwegian Aksjer. They represent an ownership interest in a company and often come with voting rights. Preferred stocks, on the other hand, do not usually have voting rights but provide investors with a fixed dividend payout.

Exchange-traded funds (ETFs) are investment funds that trade on stock exchanges, mirroring the performance of a specific index or sector. They offer investors a diversified exposure to the Norwegian stock market and are becoming increasingly popular among individual investors.

Several Norwegian Aksjer have gained popularity among investors due to their strong historical performance and market dominance. Companies such as Equinor, Telenor, and DNB are known for their consistent growth, dividend payments, and stable operations. Additionally, technology companies like Kahoot! and Adevinta have seen significant growth in recent years, attracting attention from both domestic and international investors.

Quantitative Measurements of Norwegian Aksjer

Quantitative measurements, such as financial ratios, can provide valuable insights into the performance and valuation of Norwegian Aksjer. Investors often analyze metrics like price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield.

The P/E ratio indicates how much investors are willing to pay for each unit of the company’s earnings. A lower P/E ratio may suggest undervaluation, while a higher ratio indicates overvaluation. The P/B ratio compares a company’s market value to its book value, reflecting its overall financial health. Dividend yield measures the annual dividend payment relative to the stock price, providing insights into the income potential of a stock.

By examining these quantitative measurements, investors can make informed decisions about which Norwegian Aksjer offer favorable valuations and growth potential.

Differences between Norwegian Aksjer

Norwegian Aksjer can differ significantly based on various factors, including industry, company size, growth prospects, and dividend policies. Companies operating in different sectors, such as oil and gas, telecommunications, or banking, have distinct risk profiles and growth trajectories.

Additionally, the market capitalization of companies can vary significantly, with larger companies tending to have more established operations and stability, while smaller companies may offer higher growth potential but higher risk. Furthermore, some Norwegian Aksjer have a long history of paying consistent dividends, appealing to income-focused investors.

Understanding these differences is crucial for investors to build a diversified portfolio that aligns with their risk tolerance and investment goals.

Historical Analysis of Advantages and Disadvantages

A historical analysis of Norwegian Aksjer provides insights into the advantages and disadvantages of investing in the Norwegian stock market. Historically, Norwegian Aksjer have offered attractive returns due to the country’s stable economic and political environment, as well as the profitability of its key industries like oil and gas.

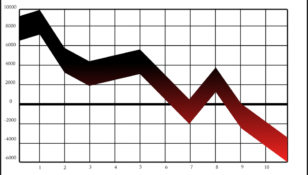

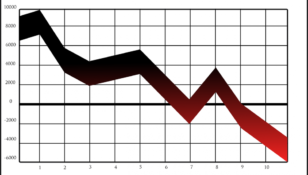

However, Norwegian Aksjer are not immune to market fluctuations and global economic trends. The stock market can be highly volatile, with prices subject to sudden changes in investor sentiment and external factors. Additionally, a downturn in specific industries, regulatory changes, or global events can impact the performance of Norwegian Aksjer.

Despite these potential risks, Norwegian Aksjer have demonstrated resilience over the years, attracting both domestic and international investors seeking long-term growth potential and stable dividend income.

Conclusion:

Investing in Norwegian Aksjer offers individuals and financial advisors a plethora of opportunities to build a diversified portfolio and capitalize on the growth potential of the Norwegian stock market. By understanding the types, popularity, quantitative measurements, differences, and historical advantages and disadvantages associated with Norwegian Aksjer, investors can make informed decisions and navigate the market with confidence.

As the Norwegian economy continues to evolve and new industries emerge, Norwegian Aksjer will remain an essential component of any investment strategy focused on long-term growth and stable returns. So, whether one is a seasoned investor or just getting started, exploring Norwegian Aksjer can open doors to exciting investment possibilities in one of Europe’s most vibrant economies.