Shorting Stocks: An In-Depth Look at This Trading Strategy

Introduction to Shorting Stocks

Shorting stocks is a popular and powerful trading strategy utilized by investors and traders to profit from a decline in the price of a particular stock. This article provides a comprehensive overview of shorting stocks, including its definition, types, popularity, and quantitative measurements. Additionally, we will compare and discuss the differences between various shorting strategies, examine their historical advantages and disadvantages, and present the implications for financial advisors.

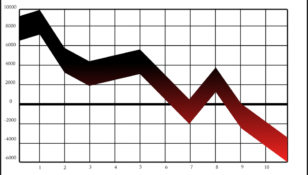

What is Shorting Stocks?

Shorting stocks, often referred to as short selling, is a technique where an individual or institution borrows shares of a stock from a broker and sells them at the current market price. The hope is that the stock price will decrease in the future, allowing the investor to buy back the shares at a lower price and return them to the broker. The difference between the selling price and the buying price represents the profit or loss of the short trade.

Types of Shorting Stocks

There are several types of shorting stocks that investors can employ, depending on their risk appetite and market conditions. The most common types include naked short selling, covered short selling, and short ETFs.

– Naked Short Selling: In this type of short selling, investors sell shares without actually borrowing them. This practice is highly controversial and subject to strict regulations due to its potential for market manipulation.

– Covered Short Selling: In covered short selling, investors borrow shares from a broker and sell them, but they also hold a position in the same stock. This strategy limits the investor’s risk as they already own the shares they need to return.

– Short ETFs: Short ETFs, or inverse ETFs, are exchange-traded funds that aim to provide returns that are the inverse of an underlying index or asset. These ETFs allow investors to profit from a decline in the market or a specific sector without engaging in individual stock shorting.

Popularity of Shorting Stocks

Shorting stocks has gained popularity among traders and investors as it offers opportunities to profit in both bullish and bearish markets. During market downturns or when particular stocks are overvalued, shorting can provide a way to hedge against losses or generate additional income. Additionally, high-profile investors and hedge funds often employ shorting strategies to take advantage of market inefficiencies.

Quantitative Measurements of Shorting Stocks

To evaluate the success and potential risks of shorting stocks, investors use various quantitative measurements. These measurements include short interest ratio, short interest percentage, and days to cover.

– Short Interest Ratio: The short interest ratio represents the number of shares sold short divided by the average daily trading volume. A higher ratio indicates a higher level of short interest in a stock, suggesting bearish sentiment.

– Short Interest Percentage: Short interest percentage is calculated by dividing the total shorted shares by the stock’s total shares outstanding and multiplying it by 100. This measurement helps investors gauge the overall level of short interest in a stock.

– Days to Cover: Days to cover provides an estimation of the number of days it would take for all the shorted shares to be repurchased. A higher number suggests that it may take longer to close out these short positions, potentially leading to a short squeeze.

Differences Between Shorting Stocks

Different shorting strategies offer distinct characteristics and advantages. For example, naked short selling may have higher returns but carries a higher risk of legal implications. Covered short selling limits the risk but may also cap the potential profit. ETFs offer a more diversified exposure to shorting but may not replicate the same returns as individual stock shorting.

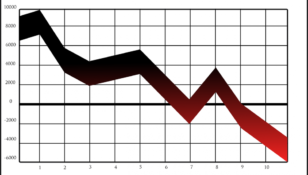

Historical Advantages and Disadvantages of Shorting Stocks

Over time, different shorting strategies have shown varying advantages and disadvantages. Shorting stocks can provide crucial liquidity to the market, help uncover overvalued stocks, and offer protection against market downturns. However, shorting can also be associated with market manipulation, increased volatility, and potentially unlimited losses for naked short sellers.

Conclusion

Shorting stocks is a sophisticated trading strategy that allows investors to profit from declining stock prices. It is crucial for financial advisors to understand the intricacies of shorting stocks, including the various types, quantitative measurements, and historical advantages and disadvantages. By incorporating this knowledge, advisors can better advise their clients on implementing shorting strategies and managing associated risks.